Money in, money out. When you get right down to it, that is all a budget really is. Of course, the “devil” is in the details. If you find yourself struggling to get everything paid off each month, then perhaps it is time to get your household on a budget. Yes, this falls under that “horrible” concept of “living within your means” but that’s a good thing. In fact, sticking with a budget will allow you to sock away money for that proverbial rainy day. It will also let you save for things like a family vacation, new car or even deposit on a home. You can get there if you stick to the plan! Here’s how to make a household budget work for you:

Money in, money out. When you get right down to it, that is all a budget really is. Of course, the “devil” is in the details. If you find yourself struggling to get everything paid off each month, then perhaps it is time to get your household on a budget. Yes, this falls under that “horrible” concept of “living within your means” but that’s a good thing. In fact, sticking with a budget will allow you to sock away money for that proverbial rainy day. It will also let you save for things like a family vacation, new car or even deposit on a home. You can get there if you stick to the plan! Here’s how to make a household budget work for you:

Step 1: Find The Right Program

We’re living in the age of apps and programs and Interwebs. There are many resources out there to help you set up your household budget. Best of all, they do all the math for you! Find a computer program or app that you like and start plugging in the numbers.

Step 2: Figure Out What You’re Spending

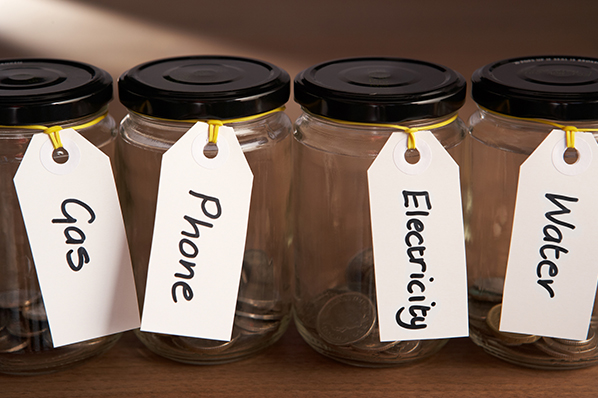

You can’t arbitrarily put yourself on a budget. You first need to know what you’re spending money on. There are some fixed costs like your phone, utilities, cable and internet that probably shouldn’t change by much each month. Of course, if you take some proactive measures to cut down on your utilities, you’ll already be ahead of the game. As for everything else you spend, take a couple of week to collect receipts. Stick them in an envelope at the end of every day. Then add up to see what you’re spending on everything from food to Starbucks. All of this is “money out.”

Step 3: Set Up A Weekly Budget

Even though a lot of bills come due on a monthly basis, it is easier to set up a weekly budget. That way you won’t be too far off the mark and won’t be tempted to cheat. This will also help you focus on your spending. For instance, if in a month you spend $800 on groceries, then clearly you should average out to $200 a week. Stick to that and see what happens.

Step 4: Look For Ways To Save

Step 4: Look For Ways To Save

Now that you know your spending habits, it’s time to start looking for ways to save. Suppose you can shave down that grocery bill with some extreme couponing? Maybe cut back on the take-out dinners and cook at home. The goal is to put those savings away for something useful.

Once you’re working on a budget, you’ll be amazed at how easy it is to save. Are you ready to work with a household budget?